Notes to Real Estate Students

RE II | Week #1 | Housekeeping Notes – 03/21/2025

I’ve attached two P&I articles offering differing views of the RE world involving Blackstone (recall: the importance of pricing).

RE II | Week #1 | Housekeeping Notes – 03/27/2025

FYI: The opening statistic in the attached Goldman Sachs report caught my eye:

“47% of workers in the District of Columbia are employed by the federal government.”

Whatever your feelings are about DOGE and Elon Musk, D.C. property owners have to feel some trepidation. This is certainly not a risk I identified when earlier pulling together my concerns about the gateway markets.

RE II | Week #1 | Housekeeping Notes – 03/29/2025

FYI: The attached WSJ article has almost nothing to do with real estate. However, I’m sure you’ll find interesting – as I did – the article’s subject matter: David Booth’s journey and new film: “Tune Out the Noise.”

RE II | Week #1 | Housekeeping Notes – 03/29/2025

FYI: While we haven’t yet gotten to the strategic aspects of leverage (Week #7), I thought I’d reiterate this opportunity (if you took RE I last quarter, it’s the same offer and there’s no need for you to re-register):

Moody’s has graciously offered to provide students with access (free-of-charge) to their various CMBS/debt-related reports; as examples, consider:

-

Quarterly Sector Updates — e.g., Sector Update – Q1 2025: Quarterly issuance of $36 billion highlights CRE liquidity, while existing CMBS DQT increased

-

Yearly Outlook — e.g., CMBS and CRE CLOs – US and Europe 2025 Outlook — Revenue will rise for most property types; maturity defaults will fall

-

Monthly CMBS Delinquency Tracker — e.g., Moody's December DQT — Increases in delinquency across core asset types drive the Conduit DQT higher

a. Excel supplement

-

Quarterly Red-Yellow-Green Reports — e.g., CMBS – US Red-Yellow-Green™ – Q3 2024 assessment of US property markets

a. Excel supplement

-

Quarterly Loss Severity US Reports — e.g., CMBS – US Loss severities – Q3 2024 update

a. Excel supplement

-

Rating Methodologies — Large Loan and Single Asset/Single Borrower Commercial Mortgage-Backed Securitizations

-

Presale Reports — e.g., Morgan Stanley Capital I Trust 2019-PLND Pre-Sale — $240.0 million CMBS large loan transaction

If you’re interested, please let me know via email and, in turn, I’ll ask Moody’s to add you to their distribution list.

RE II | Week #2 | Housekeeping Notes – 03/31/2025

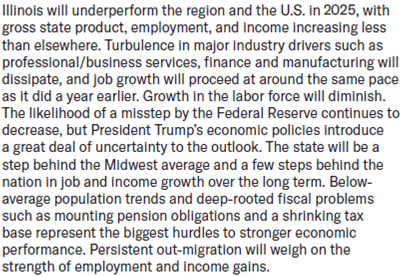

FYI: Apropos to last week’s conversation regarding gateway cities, Moody’s released this report on the State of Illinois’ economic forecast. Here’s an excerpt:

For my 2¢, I believe Moody’s is trying to straddle truth-telling and keeping their clients (directly: muni-bond investment bankers and indirectly: cities, counties and state (who hire the investment bankers)); the forecast ought to be more bleak. Nevertheless, local politicians and kowtowing newspaper reporters will spin this as happy (or, at least, not-terrible) news. Meanwhile, RE investors will have to make their own clear-minded judgments.

RE II | Week #2 | Housekeeping Notes – 04/02/2025

FYI: As part of a presentation I’m giving next week on gateway v. non-gateway cities (an update of the presentation I shared with you last week), I updated the analysis below which compares the capitalization rates of gateway cities to those of non-gateway cities. While the historical gap ≈ 50 bps, the current gap ≈ 0 bps; the marketplace certainly seems more attuned to the risks particularly faced by the gateway markets.

The investment pendulum is almost always swinging in direction or another; it’s our role as investors to develop a sense of whether it’s swung too far or not enough. Opinions will vary (and that’s what makes a market).

RE II | Week #2 | Housekeeping Notes – 04/03/2025

FYI: One of the participant’s in next week’s presentation is Rebecca Rockey (Cushman & Wakefield). She and her team have spent a great deal of time and resources on assembling “Reimagining Cities: Disrupting the Urban Doom Loop.” And while I’m generally skeptical of economists (and, even worse, urban planners) “envisioning” the future (most experts – well beyond real estate – have pretty poor track records of forecasting the future), this particular report has many an insight. (Heck, there’s even a reference to UChicago-trained economist Thomas Sowell.)

RE II | Week #3 | Housekeeping Notes – 04/06/2025

FYI: AI comes to CRE: Cadastral?

Maybe the nuance of their corporate name is lost on me, but it would seem some rebranding is in order. In any event, the application is fairly new and they may still be working on getting out the kinks. But assuming that they do, this will – in my view – make a Booth-like MBA all the more valuable, as the trite day-to-day grind of CRE investing will be AI’d away.

RE II | Week #3 | Housekeeping Notes – 04/07/2025

FYI: For those of you following the (largely flagging) investment of Chicago-based developer Sterling Bay in its Lincoln Yards project, there’s little to cheer about.

RE II | Week #3 | Housekeeping Notes – 04/08/2025

FYI: To my way of thinking, it’s shocking that LPs put up with this sort of coercion.

Private Equity Firms Ask for Cash to Let Stakes Change Hands

By Laura Benitez and Dawn Lim | March 8, 2025

(Bloomberg) -- Private equity firms are increasingly employing a fundraising tactic that makes it harder for major investors like pensions to exit their funds early, irritating clients who want cash on short notice. Buyout shops, under pressure from high rates and a shaky economy, have been asking for commitments to future funds as a condition of allowing existing stakes to change hands, according to investors. The trend is slowing down so-called secondaries, or the buying and selling of private equity fund stakes before they mature — an option gaining importance as President Donald Trump’s tariffs disrupt markets.

Major asset managers including Carlyle Group Inc. have sought the commitments in exchange for letting investors cash out, according to people familiar with the matter. But the tactic is more prominent among smaller managers, said the people, who asked not to be named because the negotiations are private. Typically the buyer of the stake is asked to provide the future investment pledge, known as a staple. The New York City Employees’ Retirement System in recent months shopped a multibillion-dollar portfolio that included a large position in Palladium Equity Partners, for example. Palladium, seeking a long-term investor, asked would-be buyers to pledge money to its new fund in exchange for letting the NYCERS position change hands, according to people familiar with the matter. The secondaries arm at Blackstone Inc., which had backed Palladium before, agreed and bought the stake.

Private equity firms have the right to approve the sales of stakes to specific buyers, said Jeff Keay, chair of the secondaries investment committee at HarbourVest Partners. “Some choose to be more aggressive than others in potentially withholding their consent,” he said, without specifying any firms. Carlyle, NYCERS, Palladium and Blackstone declined to comment.

More than $500 billion globally is dedicated to secondaries across private markets, according to Pitchbook. The market allows initial investors in funds a way to access their cash ahead of schedule. Even before global markets began selling off, a dropoff in dealmaking has been keeping capital tied up in illiquid funds for longer.

Managers refusing to sign off on trades unless buyers invest in their new funds underscores the difficulties facing private equity firms. Globally, buyout funds gathered $508 billion in 2024, down from $605 billion the year before and the lowest since 2020. It took them on average of nearly 17 months to close a fund last year, according to data from Pitchbook. That’s the second longest since 2010.

“A large number of firms who are fundraising are making these asks,” said Imogen Richards, a partner at Pantheon. Her firm has pushed back on some of the requests recently, she said, without providing specific instances.

The dynamic shows how private equity firms are trying to regain some control after investors took advantage of one of the toughest fundraising environments in years. Sovereign wealth funds and state pension providers have been demanding fee discounts, more co-investment opportunities and the release of their old capital before pledging new money. Mandating staples is one way for buyout firms to push back.

“With some GPs taking two years or more to raise funds, asking for staples, even if only a fraction of the size of what is being divested, can be very valuable,” Keay said.

--With assistance from Layan Odeh and Peter Eichenbaum.

RE II | Week #3 | Housekeeping Notes – 04/08/2025

FYI: Booth alum Howard Marks on tariffs: Nobody Knows (Yet Again) ← seems reasonably balanced to me.

RE II | Week #3 | Housekeeping Notes – 04/10/2025

FYI: As we’ve earlier discussed, the sources of CRE capital are always evolving. Before the days of institutional capital, the equity was often supplied by wealthy individuals and families. Among the first sources of institutional capital, it was often the insurance companies which were the primary sources. It then evolved, with public-sector direct-benefit pension plans (e.g., see attached IREI listing of North America investors) and endowment plans taking center stage. This list then expanded to include the sovereign wealth funds. (And, somewhere along this continuum, the public REITs became a force in their own right.)

Over the past few years, the industry’s capital sources have expanded to include the non-traded REITs (of which, BREIT is the best known), which are mostly core-plus vehicles, aimed again at wealthy individuals and families. We’re now about to expand the menu for individual investors to riskier forms of RE (and other PE) investing – see the attached P&I article. However (and as we’ll discuss next week in greater detail), these riskier forms of CRE investing have – on average – failed to deliver. This argument has been extended to all of the “alts.” If institutional investors can’t decipher good PE from bad PE, I’m not hopeful for individual investors.

Again, markets evolve and disappointment leads to change. Part of being a shrewd businessperson is to anticipate such changes and have the flexibility to evolve (if not outright lead).

RE II | Week #4 | Housekeeping Notes – 04/13/2025

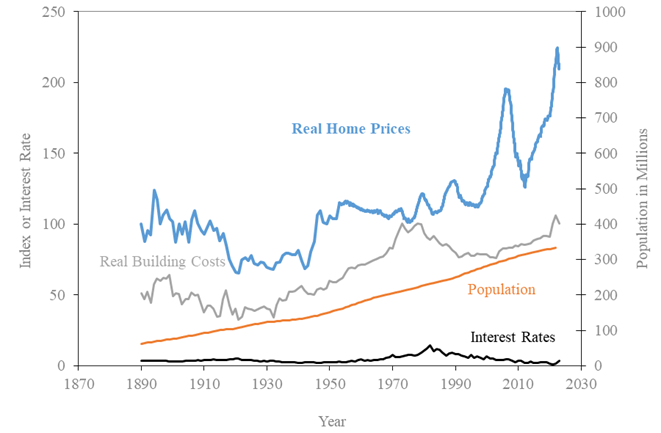

Speaking of home prices, a friend reminds me of one of my favorite graphs:

Source: Robert Shiller (Yale), Irrational Exuberance.

RE II | Week #4 | Housekeeping Notes – 04/15/2025

FYI: You might recall a conversation in Week #2 discussing the ongoing movement of some of the largest PE shops to find “evergreen” sources of capital (e.g., Apollo’s captive insurance client Athene, Blackstone’s BREIT, etc.). The attached WSJ article provides an overview of Blackstone’s pairing with Wellington and Vanguard to reach more of the private wealth channel.

{What also caught my eye is just the sheer size of BX’s non-institutional business: “As of the end of the fourth quarter, $260 billion of Blackstone’s $1.1 trillion in assets under management came from private wealth, dwarfing such assets of rivals.”}

A reminder: These evergreen funds avoid the GP’s need to constantly recycle after-tax profits into the co-investment requirement of their next fund and, for those managers which are publicly traded, Wall St. places a higher multiple on recurring earning than the idiosyncratic fees (including promotes) of finite-life funds.

RE II | Week #4 | Housekeeping Notes – 04/15/2025

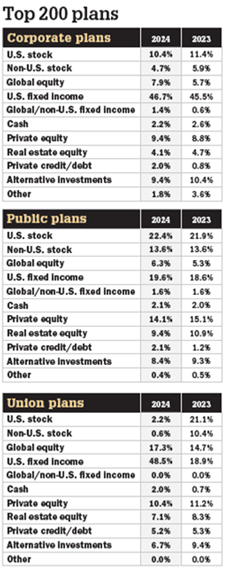

FYI: Speaking of retirement accounts, the following analysis also intrigued me (from something else I’m working on):

It’s interesting to compare the risk aversion of the corporate defined-benefit plans to the public plans when using the blunt instrument of their allocation to US fixed-income securities:

Source: “The Largest Retirement Funds,” Pensions & Investments, February 10, 2025, p.24.

Unsurprisingly (given the funding status of the typical public-sector plan), you see that the corporate plans have an allocation to US fixed income that is more than twice that of the public-sector funds.

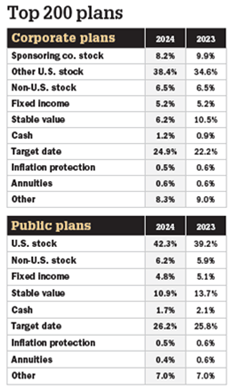

What is surprising to me is how small the bond allocations – whether private or public – with regard to the defined-contribution plans:

Source: “The Largest Retirement Funds,” Pensions & Investments, February 10, 2025, p.24.

Not only am I surprised – from the standpoint of aggressive/conservative portfolio construction – that the typical DC investor has so little invested in the bond market, I would also have thought that tax advantages of a DC plan favor investing in the bond market. A simple example: own non-dividend-paying stocks outside one’s retirement plan and own coupon-paying bonds inside one’s retirement plan ← essentially defer all tax liabilities until liquidation (and let the power of compounding work on a tax-deferred basis).

I suppose you could make an argument that many of the DC investors have a mortgage loan on their home (i.e., they’re “short” the bond market) and to invest in the bond market (in or outside of their DC plan) simply nullifies their short position. I would need some convincing that these investors have adopted this holistic view.

RE II | Week #4 | Housekeeping Notes – 04/17/2025

FYI: Obviously, tariffs are a significant source of uncertainty in the macro economy – as indicated in the attached Goldman Sachs piece. However, I’m more or less in the Green Street (and Blackstone) camp (as indicated in the attached) and summarized below:

Blackstone believes that direct first order impacts of Tariffs on its portfolio should be limited in the near term. Further, the alternative manager believes that in the long term, tariff effects would result in higher construction costs and consequently fewer development starts, which should benefit fundamentals if the economy can dodge a recession – largely in-line with Green Street's views on the topic.

My personal view is that – in one form or another – the tariffs are here to stay. (And like the earlier-circulated Howard Marks memo, I think there are some legitimate reasons to support some form of tariffs.) Whatever your economic position/beliefs, the politics seem close-to-indisputable to me. When Shawn Fein (president of UAW) gives his partial support to Trump’s tariffs (unsurprisingly, he supports tariffs on foreign-manufactured automobiles and pushes back on certain other tariffs), Democrats take notice. So as both political parties vie for the support of blue-collar middle-class voters (crucial to future elections), it seems to me that tariffs will become a signal to voters about how sympathetic either party is to those blue-collar middle-class voters.

{Of course, one of the risks in the tariffs debate is that certain industries (autos?) will be “protected” (often as a function of industry size (i.e., number of workers/voters)) and others won’t. Once you start protecting one group of workers, where does the protectionism end? And, protectionism tends to end up with a sclerotic economy. Hopefully, the current tariff discussions result in a reduction in trade barriers and, consequently, greater/freer global trade; time will tell.}

RE II | Week #5 | Housekeeping Notes – 04/21/2025

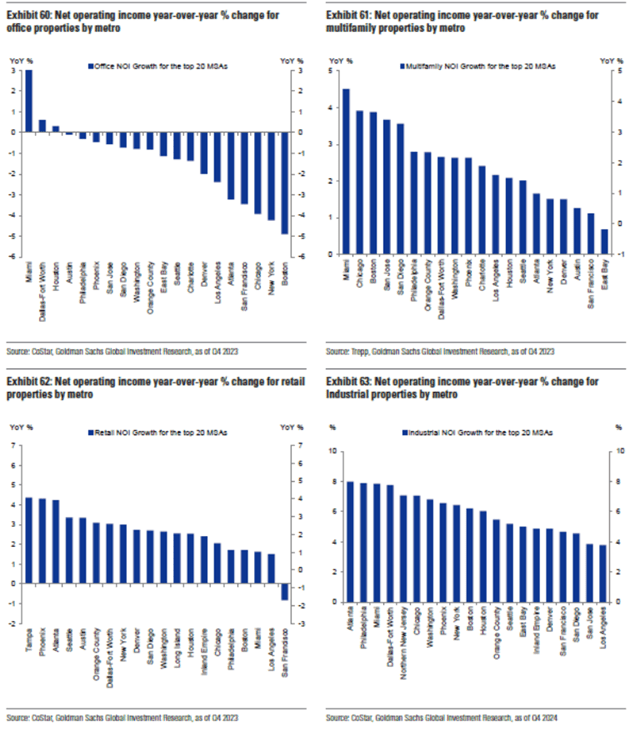

FYI: More on how the tariff discussion might affect CRE. One page caught my eye (it’s interesting how Chicago’s NOI-growth ranking seesaws between property types):

RE II | Week #7 | Housekeeping Notes – 05/06/2025

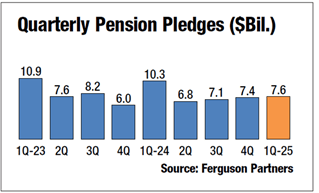

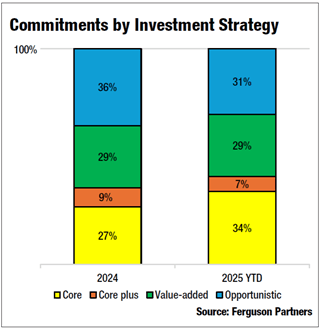

FYI: In somewhat ominous note, RE Alert indicates that pension fund commitments to RE are down (lowest level since 2013) and there’s a shift to more-conservative strategies:

The article suggests that the slowdown might be attributable to tariff uncertainties. My own view is that pension funds are starting to scrutinize the (poor) performance of non-core funds (this is consistent with the view that the “…fundraising malaise of the last two years appears to be the trajectory for 2025 as well”).

Whatever the causes, the point for soon-to-be graduating students is to earnestly pursue your employment opportunities and do your very best once you’re there.

RE II | Week #7 | Housekeeping Notes – 05/07/2025

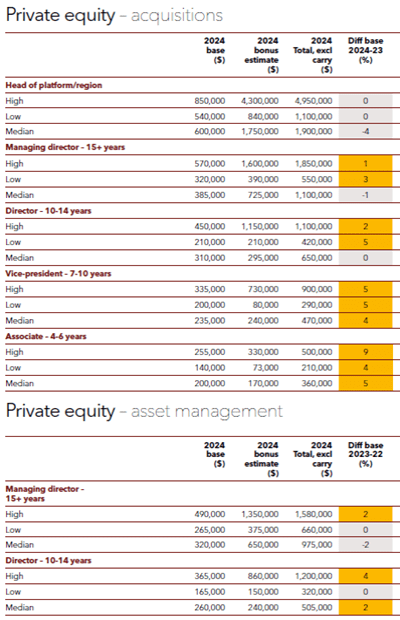

FYI: Here’s the latest issue of PERE. Among the items you might find interesting, their compensation study begins on p.44:

You’ll notice that lowly paid RE professors don’t even make the list : ) !

RE II | Week #7 | Housekeeping Notes – 05/07/2025

FYI: One outcome related to disappointing PE returns and investor unease is the rise of secondaries funds. Additionally, the following sentence caught my eye in the context of the family office:

“Ares just raised more than $3 billion for a fund that allows wealthy individuals to buy discounted stakes in private equity funds and redeem their investments quarterly.”

RE II | Week #7 | Housekeeping Notes – 05/07/2025

FYI: There’s a lot of discussion and enthusiasm for the data center sector. The attached Moody’s report provides some basic perspectives.

{My own view: There’s probably too much capital chasing these deals; nevertheless, some developers (and their investors) will likely do well – while I suspect long-term investors will be disappointed (as with many things CRE, if we need six projects, we build eight).}

RE II | Week #7 | Housekeeping Notes – 05/07/2025

FYI: Despite all the uncertainty surrounding the implementation of Trump’s tariffs, there’s no shortage of opinions (from PERE):

“Tariffs should drive up construction costs, which might constrain supply. This, coupled with lower interest rates, should improve values and spur transaction activity”

Ares Management chief executive Michael Arougheti, speaking on the manager’s Q1 earnings call about how tariffs 'should' benefit real estate

RE II | Week #7 | Housekeeping Notes – 05/07/2025

FYI: I believe these remarks were abstracted from Grant’s “Distressed Investing” conference last month. Suffice it to say, there’s very little of that I agree with (particularly as it relates to high-yield debt found way up the capital stack – see the Week #4 notes). But, everyone can place their bets as they see fit.

RE II | Week #7 | Housekeeping Notes – 05/07/2025

FYI: There’s been a great deal of discussion about extending PE investments to “Main Street” investors. This PitchBook piece summarizes much of that discussion. At least in the PE real estate space, net returns have been disappointing (see the Week #4 notes); it’s difficult to see how individual investors will improve on the poor results generated by institutional investors.

RE II | Week #7 | Housekeeping Notes – 05/09/2025

FYI: StepStone’s “house” view on the CRE markets.

RE II | Week #8 | Housekeeping Notes – 05/12/2025

FYI: Whatever your views (economic, political, military, etc.) on tariffs, here’s a presentation from Apollo on the reaction of consumers and firms; it’s chock-full of data. [In fairness, these data come from a period before the recently announced trade deals with UK and China (where the latter holds for 90 days).]

RE II | Week #8 | Housekeeping Notes – 05/12/2025

FYI: I’ve long been an advocate of public REITs getting into the fund-management business – ala ProLogis (the clear industry leader in this regard), as we’ll discuss next week – in the seemingly unending quest to gain new sources of capital (particularly those that are “evergreen”). The attached (confidential) Green Street report indicates that the market is starting to move in this direction; however, they also rightfully point out some concerns. That being said, there are a couple of related issues to consider:

- The public-market valuation of the fund-management business is influenced by the proportion of their income that comes from recurring fees v. episodic promotes – clearly, Wall Street values the former more dearly than the latter (e.g., BX’s valuation took flight with their establishing BREIT (and a massive fee generator)).

- As we discussed earlier, promotes are essentially call options on the funds’ future profitability. I continue to assert that very few investors understand how to calculate the expected value of the promote (in particular, see the Week #3 notes and the JV case); you should consider yourself ahead of the pack in this regard.

RE II | Week #8 | Housekeeping Notes – 05/15/2025

FYI: The tax treatment of carried (or promoted) interests wears on.

RE II | Week #9 | Housekeeping Notes – 05/19/2025

FYI: As to be further discussed this week, part of a successful REIT investment strategy often involves identifying the premium/discount at which the REITs trade. To that end, here are two pieces from S&P Capital IQ.

RE II | Week #9 | Housekeeping Notes – 05/19/2025

FYI: Blackstone is about to refinance 23 shopping centers found in its BEIT portfolio. Highlights include:

The certificates represent the beneficial ownership interest in a trust that will hold a $640 million, two-year, floating-rate, interest-only mortgage loan with three, one-year extension options. The mortgage will be secured by the borrower’s fee simple interest in a portfolio of 23 grocery-anchored properties located across 12 states. The properties were acquired by affiliates of BREIT Operating Partnership L.P., which will serve as the initial borrower sponsor. The properties were acquired through various separate transactions between 2019 and 2022 for a total cost basis of approximately $916.0 million.

Mortgage loan proceeds will be used to refinance approximately $493.0 million of existing debt, pay a total of $2.5 million in closing costs and return approximately $144.5 million in equity to the sponsor. The certificates will follow a pro-rata paydown for the initial 30% of the loan amount and a standard senior-sequential paydown thereafter. The borrower has a one-time right to obtain a mezzanine loan, subject to a loan-to-value ratio (LTV) and debt yield (DY) no worse than at the closing date, among other provisions outlined in the loan agreement.

Among other matters, this refinancing represents ≈ $145 million of liquidity for BREIT.

RE II | Week #10 | Housekeeping Notes – 05/27/2025

FYI: As earlier noted, Booth is co-hosting this year’s PREA Institute with Wisconsin. If you’re interested, the finalized program is attached. You’ll see that many of the topics covered in class will be part of the program.

RE II | Week #10 | Housekeeping Notes – 06/02/2025

FYI: You might recall Bill Stein’s guest lecture in Week #7; one of the topics he discussed was BX’s acquisition of (the data center REIT) QTS. The wisdom of which is now in some dispute – per the attached NY Times article. For my 2¢, I don’t generally bet against BX.

RE II | Week #10 | Housekeeping Notes – 06/05/2025

FYI: Two interesting articles from Grant’s: the first throws a little bit of shade on fan-favorite data centers and the second describes the complexity of deals in the secondary market for LP interests – candidly, I had little appreciation for how complicated it can become.